Donald Trump‘s running mate, JD Vance, previously said that Americans who don’t have children should be taxed at a higher rate than those who do.

“Let’s tax the things that are bad and not tax the things that are good,” Vance said on The Charlie Kirk Show in 2021, ABC News reported.

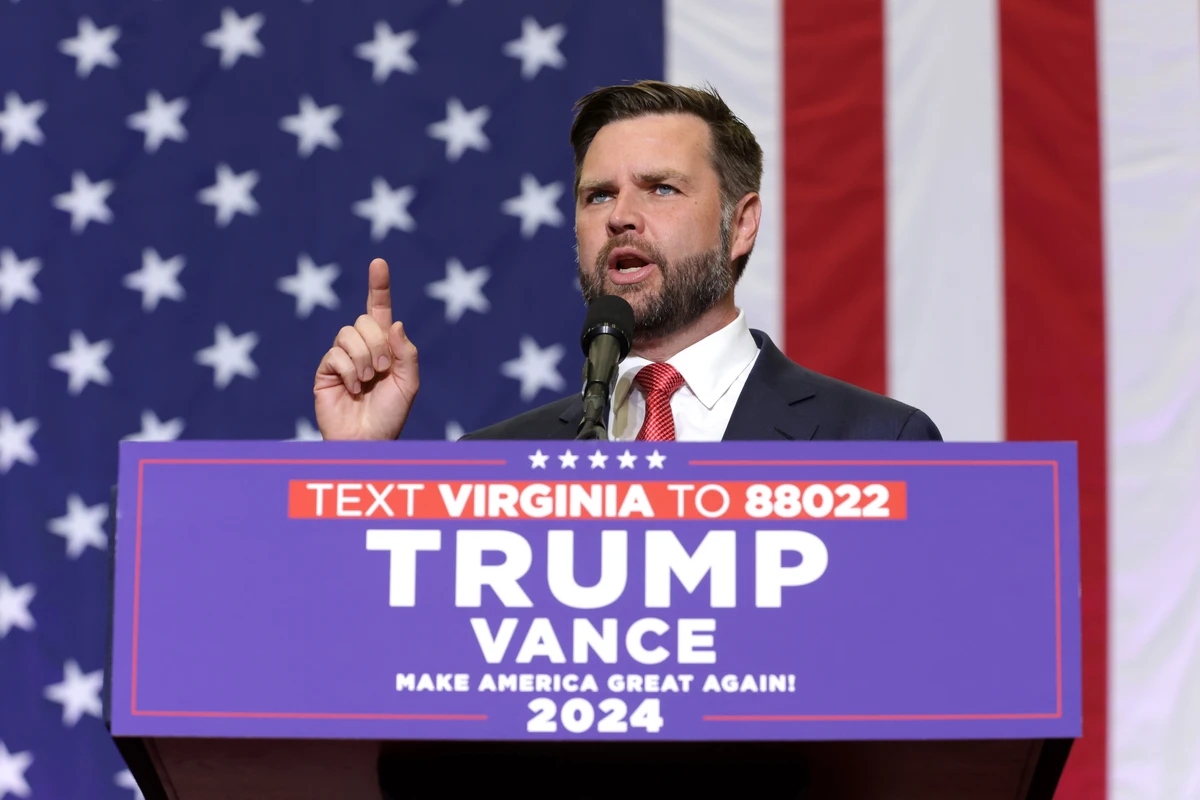

Republican vice-presidential candidate Sen. J.D. Vance of Ohio has suggested a significant change to the U.S. tax code, advocating for lower tax rates for families with children. In a resurfaced 2021 interview with political talk show host Charlie Kirk, Vance outlined his belief that the tax system should “reward” positive behaviors and “punish” negative ones.

JD Vance said Americans without kids should be taxed at a higher rate in a 2021 interview obtained by @ABC

He said: "Let's tax the things that are bad and not tax the things that are good"

Then he went on to say those with kids, "should pay a different, lower tax rate" @GMA pic.twitter.com/JEjxfWrRmW— Selina Wang (@selinawangtv) July 26, 2024

Tax Incentives for Families

Vance emphasized that families with children should benefit from a reduced tax burden. He argued that if a household earns between $100,000 and $400,000 annually and has three children, they should pay a lower tax rate compared to a childless household with the same income. Vance’s proposal centers on the idea that the tax system should support families raising children, recognizing the financial responsibilities they bear.

Clarification from Vance’s Campaign

Following the release of these comments, Vance’s spokesperson, William Martin, clarified the senator’s stance, suggesting that his remarks were essentially about enhancing child tax credits rather than imposing penalties on childless individuals. This clarification appears to aim at mitigating potential backlash or misunderstanding of Vance’s original statements.

Read More:

- Over 140,000 Claims and $90 Million in Refunds Reported: New Jersey Enters IRS Direct File Program for 2025

- Social Security Recipients: No $2,000 Debit Cards for SSI and SSDI

- Central Illinois: Law Enforcement Discovers $200,000 Worth of Drugs in Raid

The Trump-Vance Campaign’s Silence

The Trump-Vance campaign did not respond to requests for further comment on the proposal. This silence leaves some questions unanswered regarding the specifics of how such a tax policy would be implemented and its broader economic implications.

Kamala Harris Reaffirms Tax Pledge

In a contrasting move, presumptive Democratic presidential nominee Kamala Harris has reiterated her commitment to a key tax pledge made by President Biden. A spokesperson for the Harris campaign confirmed that she would maintain the promise not to raise taxes on individuals earning less than $400,000 per year if elected. This pledge aligns with Biden’s vision of creating a tax system that “rewards work, not wealth.”

Harris’s Tax Policy Stance

Harris’s stance is particularly noteworthy given her previous support for increasing taxes on higher-income earners, specifically those earning at least $100,000 annually, to fund an expansion of Medicare. Her reaffirmation of the $400,000 threshold suggests a commitment to continuity in tax policy, even as she considers broader healthcare reforms.

Conclusion

As the 2024 election season heats up, tax policy continues to be a significant point of debate. Vance’s proposal for a family-friendly tax code and Harris’s commitment to maintaining the current tax threshold reflect differing visions for the future of American tax policy. Voters will have to consider these proposals carefully as they evaluate the candidates’ platforms and their potential impacts on the economy and society.