Marquisha Mccullough, just like millions of people in Tennessee, faced difficult times when the pandemic struck. She lost her job selling insurance and found herself in a challenging situation.

“I was in the business of selling supplemental insurance policies to business owners with employees,” Mccullough recalled. “At that time, I was also expecting a child. However, when the lockdown was imposed, everything came to a halt. It was an incredibly stressful situation, and I had to come to terms with the fact that I had lost my job.”

As a single mother, I recently moved into a new apartment. In order to make ends meet, I decided to apply for unemployment benefits. Thankfully, I started receiving payments from April 2020 and continued to receive them until late June 2021.

“When I initially applied, it was during the time when the CARES Act was signed into law by Donald Trump,” Mccullough explained. “This was a significant moment because it allowed 1099 contractors and independent workers to access unemployment benefits due to the impact of COVID-19, marking the first time in U.S. history that such individuals were eligible for such benefits.”

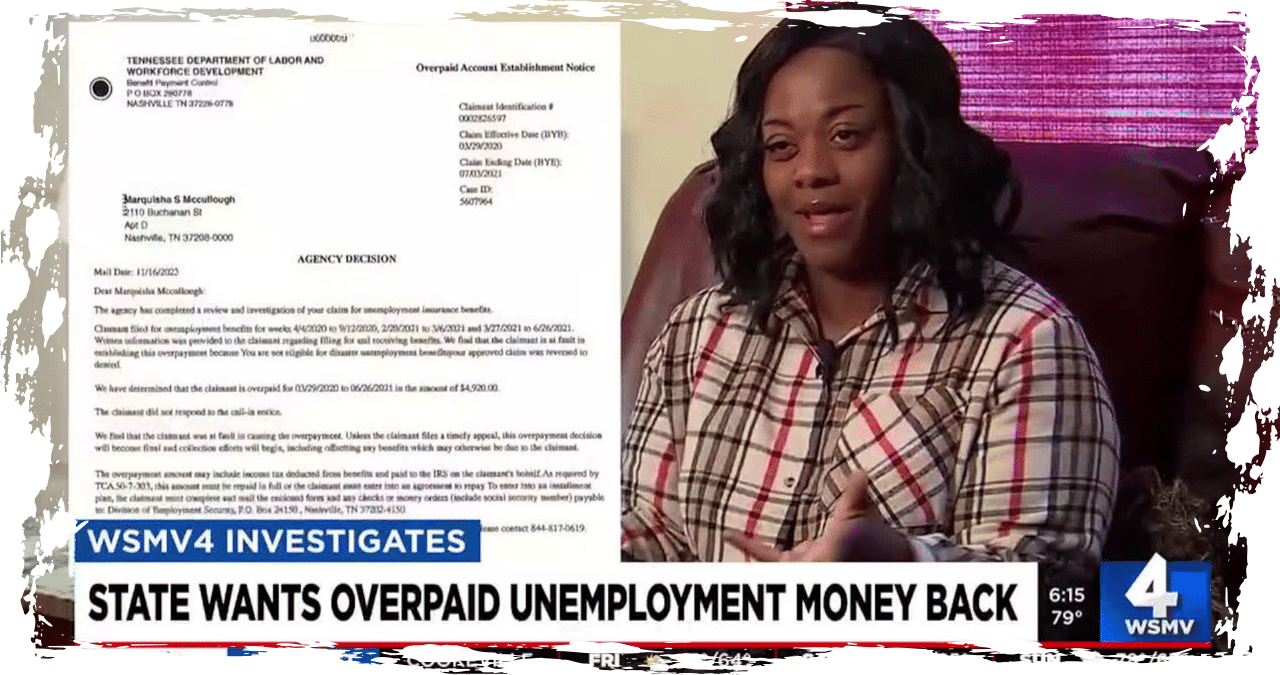

In November 2021, the Tennessee Department of Labor made a determination stating that Mccullough was ineligible to receive pandemic unemployment assistance benefits. Consequently, they determined that she had been overpaid and deemed her at fault for the situation. As a result, her request to have the claim waived was subsequently denied.

In December 2023, the tribunal hearing her case overturned the initial decision and ruled that Mccullough was not responsible for the overpayment.

The department was instructed to investigate whether she qualified for a waiver, so the case was remanded to them.

According to a spokesperson from the Department of Labor, they sent an email to Mccullough on April 15, 2024, as a reminder that she still had the option to file a waiver.

The department mentioned that she failed to fill out the form and also did not provide the requested documentation regarding her employment status.

Mccullough mentioned that she does not remember receiving an email regarding the waiver. She stated that she has submitted all the documents she had from the period between 2020 and 2021. Lately, the only correspondence she has received from the Department of Labor are intimidating collection notices.

“This last letter is written in all caps, with the words FINAL, FINAL, FINAL,” Mccullough explained. “It makes me feel like I’m being targeted by some organized group, and it’s been causing me sleepless nights.”

Mccullogh recently lost her job again and is now facing the garnishment of her new claim for unemployment benefits and income tax refund by the department.

“I’ll be pretty messed up if you come back after four years and claim that I owe you $22,000. I didn’t break any laws or commit fraud. It’s not my fault. So, what’s really going on?” Mccullough exclaimed.

WSMV4 Investigates reached out to the Department of Labor for an interview regarding unemployment overpayments during the peak of the pandemic. However, representatives from the agency declined to appear on camera.

Here are the figures provided by the department:

Between March 2020 and July 2021, there were a total of 1,256,789 claims filed.

Between March 2020 and September 2020, a staggering $1.6 billion in claims were paid out.

Between March 2020 and July 2021, a total of 23,799 claims were overpaid.

Between March 2020 and July 2021, there were overpayments totaling $63,177,227.

According to the department, Tennessee provides an option for a non-fault waiver in situations where there has been an overpayment of underemployment benefits. In such cases, individuals have a period of 90 days from the determination of the non-fault overpayment to submit a completed waiver form to the department for review.

Mccullough asserts that she has submitted all the necessary documents to the department right from the start, in order to demonstrate her eligibility and rightful claim for unemployment benefits under the CARES Act.

Mccullough mentioned that the process has become incredibly complex due to the numerous appeals, waiver forms, and collection notices. As a result, she is uncertain about the specific requirements of the department, and a significant portion of the information they are requesting has already been lost or discarded.

“I’m unable to fill out the waiver form since it requires me to provide bills, but my bills have changed over time, and I don’t have statements from three or four years ago. I never anticipated that I would need to keep them,” expressed Mccullough.

Frustrated, Mccullough is unsure about her next steps, fearing that she is rapidly running out of options and unable to repay the money that the Department of Labor insists she still owes.