According to him, a potential solution to this issue is for Americans to extend their working years before they transition into retirement.

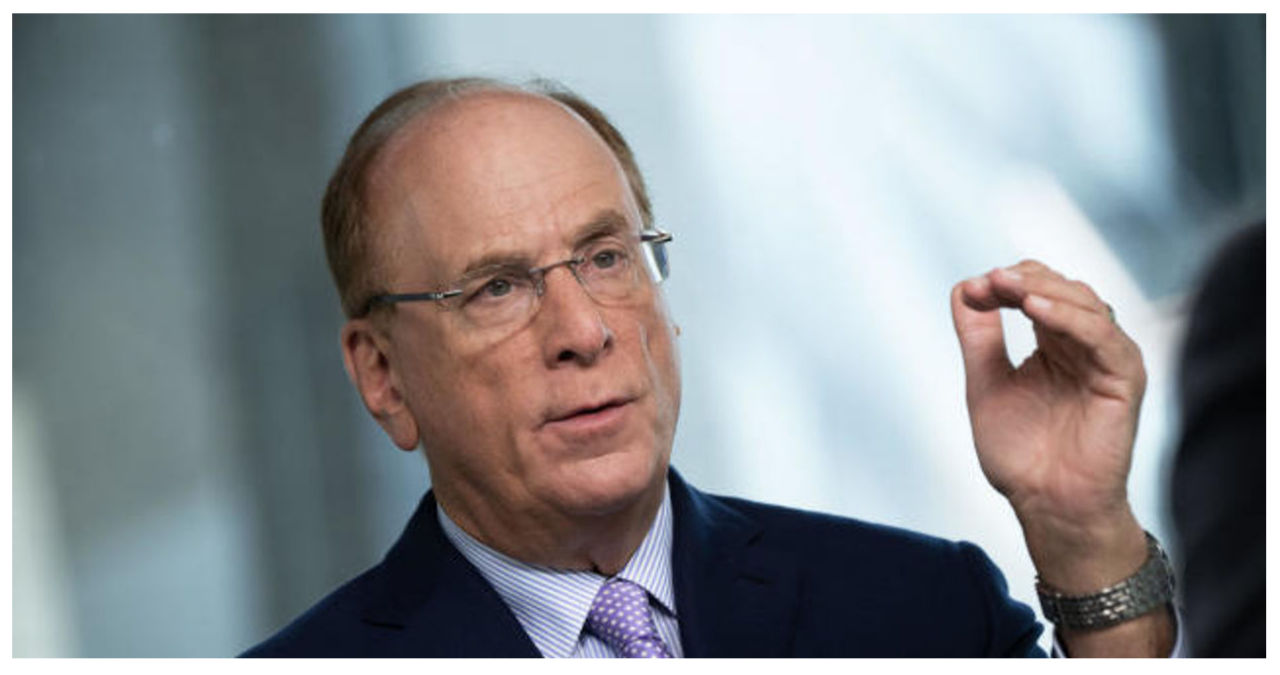

According to Fink, a billionaire with an estimated net worth of $1.2 billion, it is important to consider that during the early 1950s, a significant number of 65-year-olds did not have the opportunity to retire due to premature deaths. In fact, Fink points out that over half of the workers who had contributed to Social Security did not receive any benefits as they passed away before reaching the age of eligibility.

According to Fink, the shifting demographics in our society are a positive development as people are living longer lives. However, it is important to acknowledge the significant impact this has on our retirement system.

In the midst of discussions regarding the nation’s retirement crisis, Fink proposes potential solutions. This topic coincides with the ongoing debate on the future of Social Security, which is projected to experience a funding shortfall within the next ten years. Certain Republican lawmakers advocate for an increase in the retirement age for claiming Social Security benefits, echoing Fink’s sentiment that as Americans live longer, they should also work longer.

According to a 2022 survey by AARP, it is evident that the issue of ageism in the workplace cannot be overlooked, as a majority of workers over 50 report experiencing it. Moreover, many older Americans are forced to stop working earlier than anticipated due to health issues or unexpected job losses. Surprisingly, the median age of retirement in the U.S. is 62, which is even lower than the commonly perceived “traditional” retirement age of 65.

Retirement expert and New School of Research professor Teresa Ghilarducci agrees with Fink’s assessment that the retirement system is failing to benefit the majority of households, as reported by CBS MoneyWatch.

But according to her, his judgment that individuals should extend their working years is misguided. She pointed out that a significant number of Americans have not had the opportunity to save for their later years. In fact, approximately 30% of workers aged 59 or older do not have any retirement savings.

“Why aren’t most workers able to save for retirement easily after a 40-year experiment with a voluntary, do-it-yourself-based pension system?” she questioned. “Furthermore, in developed countries, why isn’t age 65 considered a suitable goal for workers to retire from their jobs?”

According to her, simply working longer hours is not the solution to our problems. Besides, she also pointed out that most individuals are unable to retire at the time they desire.

Vested interest?

The retirement gap in America, which refers to the disparity between the amount of money people need to fund their retirement and what they have actually saved, is not a new issue. Similarly, the impending funding crisis faced by Social Security has also been a known concern. However, what makes Fink’s remarks significant is his position as the CEO of the world’s largest asset manager, overseeing over $10 trillion in assets, including numerous retirement accounts.

Larry Fink, the CEO of BlackRock, has a clear incentive to encourage Americans to increase their retirement savings since his company benefits from the fees collected from these accounts. In his letter, he also highlights a new target-date fund called LifePath Paycheck, which is set to launch in April. This fund aims to provide a reliable source of income during retirement.

According to Laurence Kotlikoff, an economist at Boston University and an expert on Social Security, there are many people in the financial industry, particularly on Wall Street, who aim to privatize Social Security and profit from it.

Fink also commends successful public policy initiatives that have tackled the issue of retirement savings. For instance, he lauds Australia’s system, which was implemented in the early 1990s and mandates that employers contribute a portion of their workers’ income to a retirement fund. Despite having the 54th largest population globally, Australia boasts the 4th largest retirement system in the world, as Fink points out.

“We should make retirement investing more automatic for workers as a nation,” he emphasized.

According to Fink, his mother, an English teacher, and his father, a shoe-store owner, were never among the highest earners. However, they were able to save enough money for a comfortable retirement. In fact, their savings could have lasted until they turned 100, even though they passed away before reaching that age.

One of the reasons for their secure retirement, he highlights, is that his mom, being a state employee, was able to participate in California’s state pension system, CalPERS. However, the availability of pensions has decreased by half since 1980. In 2021, only about 15% of employees have access to defined benefit plans compared to 30% four decades ago, as reported by the Congressional Research Service.

Can boomers fix the problem?

According to Fink, who was born in 1952, his generation has a responsibility to address the retirement challenges in the country. He pointed out that the financial instability experienced by younger Americans, including millennials and Gen Z, is leading to a generation of disillusioned and anxious workers.

In a recent article, Fink acknowledged that there is a growing concern among younger generations that the baby boomers, including himself, have prioritized their own financial prosperity at the expense of future generations. Specifically, Fink admitted that when it comes to retirement planning, the concerns of the younger generation are valid.

“We have an obligation to change that,” he emphasized, “before my generation fully disappears from positions of corporate and political leadership.”

According to Fink, the retirement crisis not only affects the retirements of individual Americans but also undermines the collective belief in the future of the United States. Boomer lawmakers and politicians may have differing opinions on how to address this issue, but it is crucial to find a solution as the consequences of failing to do so are significant.

In his observation, he pointed out that there is a danger of our country transforming into a place where individuals hide their money under their mattresses and suppress their aspirations within the confines of their bedrooms.