The Biden administration has proposed a new rule that could significantly improve the ability of millions of Americans to purchase a home or a car. The proposed rule aims to ban medical debt from being included in credit reports, bringing a sweeping change to the credit reporting system. This move could provide relief to individuals who have been impacted by medical debt and help them gain access to credit more easily.

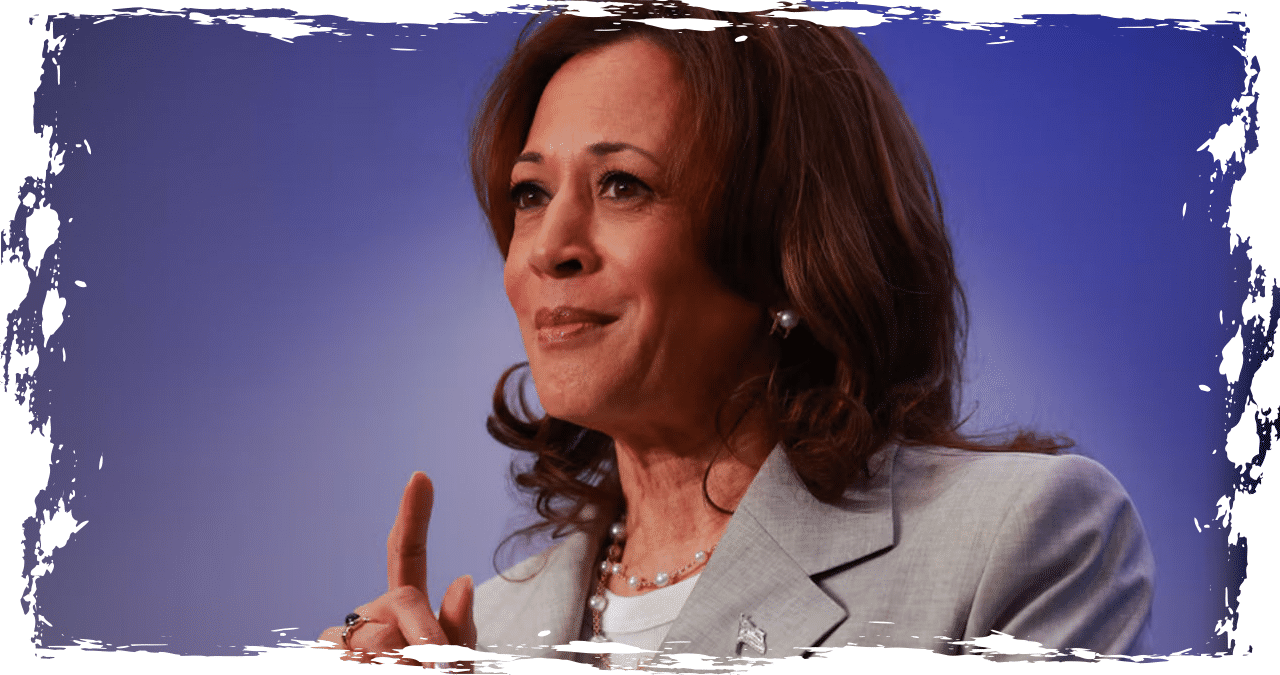

Vice President Kamala Harris and Consumer Financial Protection Bureau Director Rohit Chopra have announced a new rule, which aligns with President Joe Biden’s efforts to convince Americans that his administration is focused on reducing costs – a major concern for voters in the upcoming election.

In an exclusive interview with ABC News before the policy announcement, Chopra expressed his belief that many people struggling with medical bills related to hospital visits will feel a great sense of relief. He stated, “This is going to be an enormous relief to so many people battling bills when it comes to hospital visits.”

The rule, which was proposed in September, may become effective in the beginning of next year.

Chopra stated that their research has revealed that having medical bills on one’s credit report does not indicate the likelihood of repaying other types of loans. Therefore, including medical bills on credit reports unfairly and inappropriately affects people’s credit scores.

According to the research conducted by CFPB, approximately 22,000 additional individuals will become eligible for secure mortgages annually, owing to the implementation of the new rule. This will not only benefit borrowers but also assist lenders in approving a larger number of borrowers, resulting in an improvement in their credit scores.

Several prominent credit report companies, such as Equifax, TransUnion, and Experian, have already implemented measures to exclude certain medical debts from their creditworthiness calculations. In a similar vein, FICO has recently reduced the weightage of medical debt in its scoring system. Furthermore, VantageScore does not take medical debt into account in its newer models.

According to the CFPB, despite progress being made, there are still 15 million Americans who suffer from $49 billion of medical debt negatively impacting their credit scores. The proposed rule aims to expand the current practice of excluding medical debt from credit reports to include all credit reporting in the United States.

According to KFF, medical debt is a widespread issue in the United States, affecting 40% of Americans. Most individuals have accumulated thousands of dollars in debt due to medical expenses.

When debts are sent to collections, it can have a negative impact on credit scores. This can make it challenging for individuals to obtain car or home loans, or they may only be offered loans with high interest rates. For those who are already struggling to pay their bills, this can create a slippery slope.

During a press call on Tuesday, Harris expressed how medical debt has made it challenging for millions of Americans to obtain approval for necessary loans such as car loans, home loans, or small business loans. This, in turn, makes it difficult for them to meet their basic needs and achieve financial stability. Harris emphasized that this situation is unjust and calls for immediate action.

When Lexi Coburn was 23 years old and without insurance, she encountered the problem of medical debt for the first time almost a decade ago in 2013. Now 33, she still remembers the financial burden it placed on her.

She couldn’t walk due to the swelling in her feet, which left her with no option but to head to the emergency room. Being uninsured, she was left with no choice but to seek medical care there. Upon examination, she was diagnosed with early onset arthritis.

As a young adult, Coburn was frequently unable to cover medical expenses due to her family’s financial constraints. Thus, when she received a $425 medical bill, she was unable to pay and left it unpaid. Her past experiences left her feeling ill-prepared to navigate the complexities of the medical system.

Despite enrolling in health insurance through the Affordable Care Act, Coburn’s medical debt continued to mount and reached a staggering $2,300. In 2019 alone, she incurred an additional $1,532 in debt from dental work and a separate visit to the emergency room.

When she attempted to purchase a car, the repercussions became evident.

Coburn voiced out that her medical debt hindered her from qualifying for a decent loan that wouldn’t require an exorbitant monthly payment.

Coburn expressed that the most exasperating experience for him occurred during his mid-twenties when he struggled to earn a substantial income. He had to ensure that he had a means of transportation to commute to his job, which was a pressing concern for him.

According to her, the mounting financial cycle was becoming increasingly risky. The bills from Coburn and her low credit score were hindering her ability to flourish and pay off the debt. As a result, it seemed like a domino effect that was difficult to break free from.

According to Chopra, the CFPB’s latest rule aims to tackle the problem of inaccurate, perplexing, and convoluted medical bills. These bills often result in prolonged and challenging disputes between patients and billing departments, which is a common grievance that the agency hears frequently. As an agency responsible for empowering consumers, the CFPB is taking steps to address this issue.

According to him, it is quite common to come across bills that are not accurate, and unfortunately, this leads to prolonged disputes between patients and healthcare providers. He further added that it is disheartening to see patients having to fight for months to resolve such billing errors, only to find out that it has negatively impacted their credit report.

Those who endorse the CFPB’s proposed rule highlight the fact that the success rate for collecting medical bills is already quite low.

According to health economics expert, Matt Notowidigdo, the repayment rates for medical debt are already extremely low. Therefore, he believes that the recent policy change will not significantly alter people’s current behavior of not paying down their medical debts.

A Michigan resident named Linda Davis, who is 61 years old, has chronic obstructive pulmonary disease, a type of lung disease, and she uses a power wheelchair due to a lower back injury. According to her, she believes that her medical bills, which are estimated to be between $45,000 and $50,000, will never be fully paid off.

Davis expressed that there is a common misconception that having Medicare means one is completely covered, but that is far from the truth. In reality, it can create havoc and take over one’s entire life. “It takes control of your whole life,” she shared.

In her own words, she mentioned that her monthly earnings are sufficient to pay for her rent, electricity, cell phone bill, and groceries. However, she is unable to accommodate her medical expenses in her budget due to financial constraints.

Davis expressed concern about the mounting medical bills after the procedure. He mentioned that it was impossible for him to pay them all, even if he made small monthly payments. He further added that he wouldn’t live long enough to pay off all the bills.

According to Notowidigdo and other health economists, the solution to America’s medical debt problem lies in enrolling more people in sufficient healthcare coverage in the first place. This approach is preferable to dealing with unpaid medical bills resulting from inadequate or absent insurance coverage after the fact.

Hospitals and healthcare systems are currently facing the challenge of coping with large bills and low repayment rates.

Experts caution that if the CFPB rule results in a decrease in the number of people settling their bills, it may ultimately be the patients who bear the brunt of the consequences.

According to Ge Bai, a professor specializing in accounting health policy at Johns Hopkins University, hospitals are likely to compensate for the revenue loss through alternate means. This could entail implementing stricter payment policies, such as demanding payment upfront before administering medical care, which may negatively impact low-income patients.

According to Bai, patients are likely to benefit from this development in the short term, and it is possible that patient advocacy groups will support it. However, as time passes and the negative consequences become more apparent, there may be increased resistance to the idea.

Bai’s concerns have been echoed by industry groups such as the Association of Credit and Collection Professionals.

In response to the CFPB’s proposal, ACA CEO Scott Purcell expressed concern that it would have a widespread negative impact on businesses, health care providers, patients, and consumers alike. The proposal’s aim to suppress information about a consumer’s debt could lead to increased medical costs and upfront payments, ultimately reducing access to credit and health care for those who need it most. Purcell stated, “The rule, if finalized, would fundamentally alter the U.S. credit-based economy as it is today in terms of reduced consequences for not paying your bills.” The proposed rule has the potential to drastically change the current credit-based economy, which could have far-reaching consequences.

According to Chopra, the idea that more individuals will default on their healthcare debts due to the new rule is unfounded. He asserts that debtors will still be subject to other penalties, despite the rule changes.

Chopra expressed concern that despite the new policy, individuals who fail to pay their bills may still face collection actions, lawsuits, and other penalties. He emphasized that he does not want the credit reporting system to be used as a means to punish people who have already settled their debts. “There are numerous ways in which non-payment of bills can result in penalties. My main concern is that the credit reporting system should not be weaponized against individuals who have already fulfilled their financial obligations,” Chopra stated.