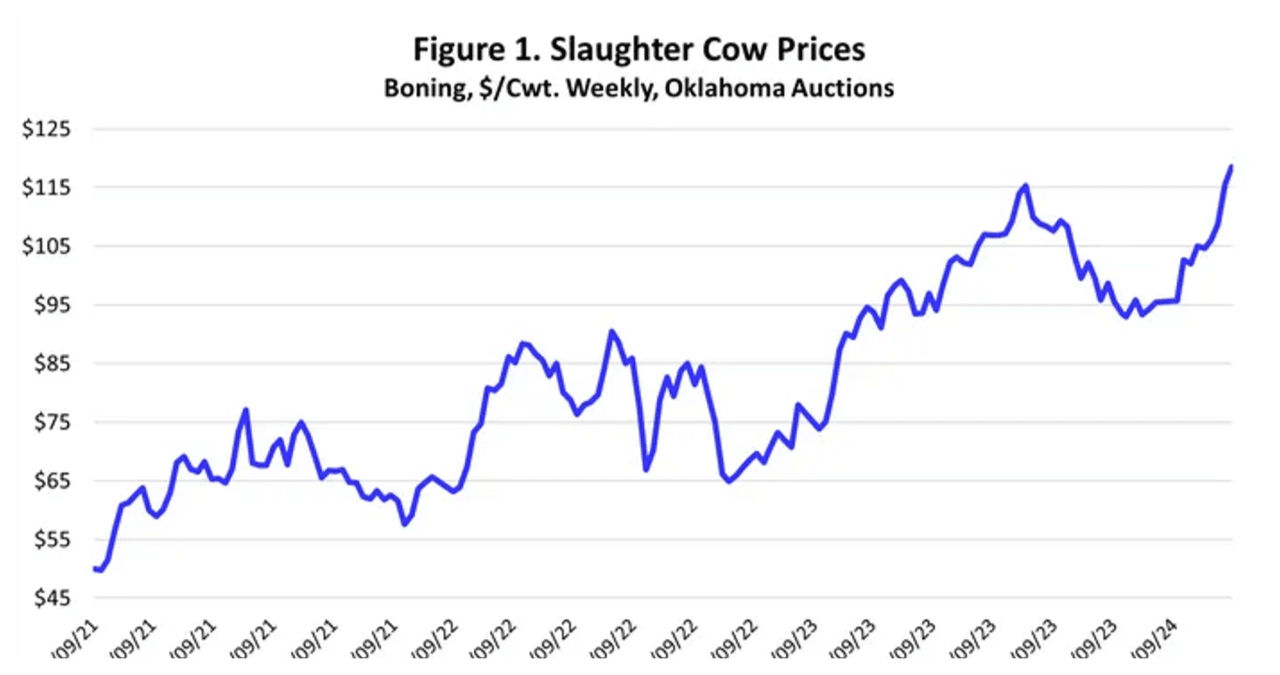

Slaughter cow prices are on the rise due to a decrease in cow inventories and reduced cow slaughter. In Oklahoma auctions, the average price for boning cows reached $118.54/cwt. (average dressing) during the week ending March 8, 2024 (Figure 1). The prices for slaughter cows varied, ranging from $126.87/cwt. for high dressing breaking cows to $99.13/cwt. for low dressing lean cows.

Slaughter cow prices are influenced by the price of 90 percent lean beef trimmings (90s), which reached a record high of $317.36/cwt during the first week of March. This marks the highest price for 90s since data collection began in 1978. The supply of non-fed beef, which includes cows and bulls, has decreased by 12.7 percent compared to the previous year. This decline is primarily driven by a 13.1 percent decrease in cow slaughter. Dairy cow slaughter has seen a significant drop of 15.0 percent, while beef cow slaughter has decreased by 11.4 percent. Bull slaughter in 2024 has also experienced a decline of 9.4 percent compared to the previous year.

Lean beef trimmings play a vital role in the production of ground beef. Both lean and fatty trimmings are utilized to meet the demand for ground beef in the food service and retail grocery markets. The industry standard for ground beef is a ratio of five pounds of 90s (lean trimmings) to one pound of 50s (50 percent lean trimmings), resulting in 83.3 percent lean ground beef. However, the price of 90s has risen significantly, leading to a wholesale ground beef reference price of $281.28/cwt. in the first week of March. This price surpasses the reference price observed during the pandemic disruptions in 2020 and represents an all-time high for ground beef.

The ground beef market relies heavily on lean beef imports, which make up a significant portion of the U.S.’s beef imports. With a decrease in domestic lean beef supplies and an increase in prices, the market responds by importing more beef to mitigate the impact within the country. As a result, beef imports in 2023 saw a 9.9 percent increase compared to the previous year. The most recent data for January shows a substantial 38.1 percent year-over-year increase in beef imports. Typically, beef imports are front-loaded at the beginning of the year as countries, particularly Brazil, rush to fill the unassigned “Other Country” import quota. However, monthly imports are expected to stabilize as the year progresses, and overall imports for 2024 are projected to grow by 12-13 percent compared to the previous year.

Slaughter cow and wholesale ground beef prices are expected to rise in the upcoming months. The net cow culling rate, which includes both beef and dairy cows, decreased from 17.8 percent in 2022 to 17.2 percent in 2023. However, during the previous herd expansion, net cow culling dropped to a low of 13.3 percent in 2015. If herd rebuilding starts in earnest in 2024, cow slaughter will decrease more significantly. Additionally, without herd rebuilding, cow slaughter will naturally decrease in 2024 due to smaller cow inventories.