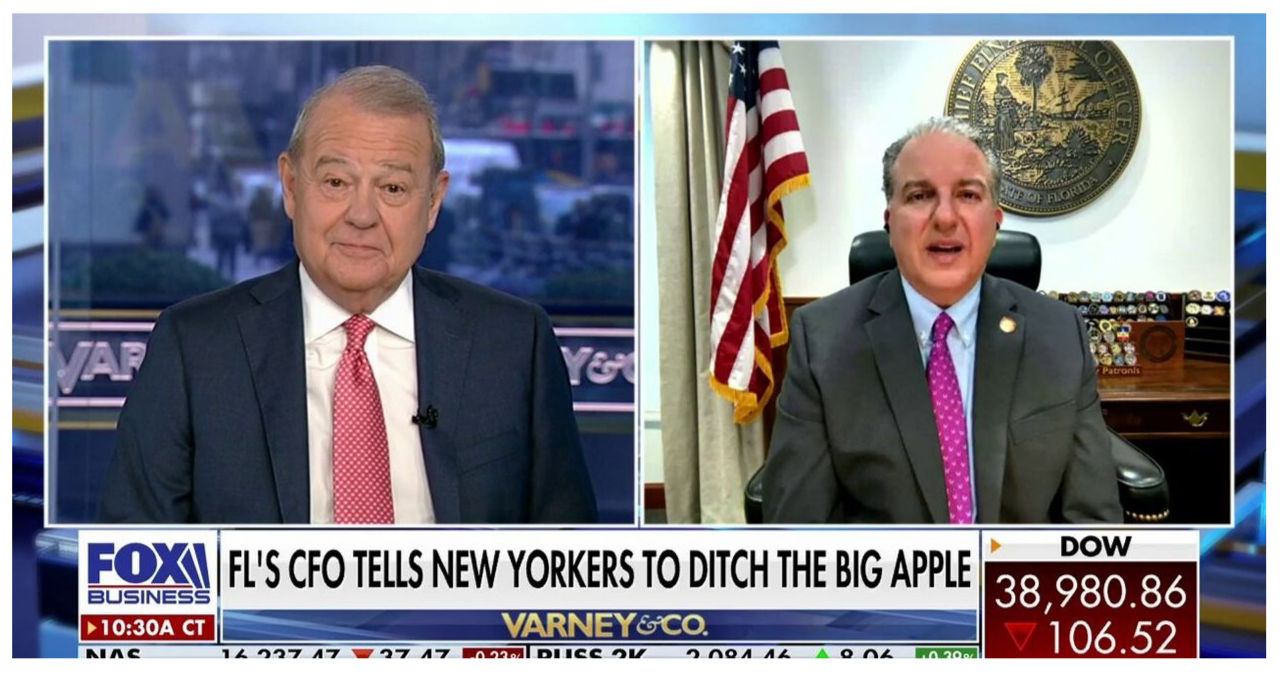

In a recent interview, Florida Chief Financial Officer Jimmy Patronis shared his thoughts on two important topics: attracting New York businesses to the sunny state and the possible ban on menthol cigarettes.

Florida’s Chief Financial Officer, Jimmy Patronis, is highlighting Florida’s favorable economic climate as an attractive option for businesses in states like New York, which struggle with higher tax rates and stricter regulations.

Patronis, Florida’s CFO since June 2017 under Governors Rick Scott and Ron DeSantis, expressed in an interview with FOX Business that the high taxes, restrictive regulations, and the recent fraud ruling against former President Donald Trump have rendered New York an unfriendly and unpredictable environment for businesses.

“We see this as a chance to seize the opportunity. I am constantly in touch with businesses and firms in New York who are considering moving to Florida,” stated Patronis.

Florida has taken proactive measures to remove barriers for business development, demonstrating its commitment to creating a conducive environment for economic growth. The state is actively promoting its openness for business, signaling its eagerness to attract entrepreneurs and investors.

Pay Fewer Taxes While Living in or Owning a Business in These 10 US States

Are you looking for ways to minimize your tax burden? Look no further! We have compiled a list of the top 10 US states where you can pay fewer taxes. Whether you are a resident or a business owner, these states offer some attractive tax benefits.

1. Alaska: Known for its breathtaking landscapes, Alaska is also a tax haven. The state has no individual income tax or state sales tax. This means more money in your pocket for exploring the great outdoors.

2. Florida: With its sunny weather and beautiful beaches, Florida is a popular destination for retirees. The state has no income tax, which can significantly reduce your tax liability.

3. Nevada: Home to the famous Las Vegas Strip, Nevada is another state with no income tax. If you enjoy entertainment and nightlife, Nevada might be the perfect place to call home.

4. South Dakota: Known for its stunning natural beauty, South Dakota also offers residents the advantage of no state income tax. This can be a significant savings for individuals and businesses alike.

5. Texas: Everything is bigger in Texas, including the tax benefits. The Lone Star State has no individual income tax, allowing you to keep more of your hard-earned money.

6. Washington: If you love the Pacific Northwest, Washington might be the ideal state for you. With no state income tax, you can enjoy the stunning scenery and vibrant city life without the added tax burden.

7. Wyoming: Known for its wide-open spaces and picturesque landscapes, Wyoming is also a tax-friendly state. With no state income tax, you can enjoy the beauty of the Cowboy State while keeping more money in your pocket.

8. New Hampshire: As one of the New England states, New Hampshire offers a unique advantage for residents. The state has no income tax or sales tax, making it an attractive option for those looking to save on taxes.

9. Tennessee: Home to country music and the Great Smoky Mountains, Tennessee is a state with no income tax. This can be a significant benefit for individuals and businesses alike.

10. New Hampshire: Rounding out our list is New Hampshire, another state with no income tax. With its beautiful landscapes and charming small towns, New Hampshire offers residents a great quality of life with lower tax burdens.

Remember, when it comes to taxes, every dollar saved can make a difference. Consider these 10 US states when making your next move or deciding where to establish your business. By taking advantage of their tax-friendly policies, you can keep more money in your pocket and enjoy the benefits of living or owning a business in these states.

Florida aims to lure businesses away from high-tax and heavily regulated states like New York. This move is part of their strategy to attract companies seeking a more favorable business environment.

Florida has experienced a significant increase in its population as a result of individuals moving from New York to the Sunshine State. The U.S. Census Bureau’s data revealed that a total of 91,000 individuals made the decision to leave New York and settle in Florida in 2022.

According to Patronis, the trend of people moving to Florida continued in 2023. He mentioned, “Last year, the state welcomed 400,000 new net Floridians, which translates to an average of 1,200 individuals per day. Along with them, they brought a substantial amount of wealth, totaling $39 billion, which includes retirement accounts, business assets, and personal assets.”

Florida’s Parental Rights Law Upheld After Federal Court Settlement, DeSantis Celebrates ‘Major Win’

The controversial Parental Rights Law in Florida has been upheld following a settlement in a federal court, prompting Governor Ron DeSantis to hail the decision as a “major win.” The law, which was passed in 2021, grants parents more control over their children’s education and medical decisions, and has faced significant opposition from critics who argue that it undermines children’s rights and could potentially harm vulnerable populations.

The settlement comes after the law faced legal challenges from various advocacy groups, including the American Civil Liberties Union (ACLU) and Planned Parenthood. These groups argued that the law violated the constitutional rights of minors by giving parents the final say in matters such as vaccinations and mental health treatment.

Under the law, parents must be notified and give consent before any medical procedures or treatments are administered to their children, including vaccinations, abortions, and mental health treatment. It also allows parents to opt their children out of certain school curriculum, such as sex education or discussions on gender identity.

Supporters of the law argue that it reinforces parental rights and ensures that parents have the final say in their children’s upbringing. They believe that parents are best equipped to make decisions regarding their children’s well-being and that the law provides them with the necessary tools to do so.

Opponents, on the other hand, claim that the law infringes upon children’s rights and puts vulnerable populations, such as LGBTQ+ youth or those seeking mental health treatment, at risk. They argue that parents may not always act in their children’s best interests and that the law could prevent minors from accessing necessary medical care or education.

The settlement in the federal court means that the law will remain in effect, upholding the rights of parents in Florida. Governor DeSantis praised the decision, stating that it is a “major win” for parental rights and individual freedom.

However, critics of the law have vowed to continue fighting against it, arguing that it is discriminatory and harmful to children. They believe that the law sets a dangerous precedent and could potentially be used to further restrict the rights of minors in the future.

As the legal battle continues, the controversy surrounding Florida’s Parental Rights Law remains unresolved. The settlement in the federal court is a significant development in the ongoing debate over the balance between parental rights and children’s rights, and it is likely to have far-reaching implications for similar laws and policies in other states.

Florida Chief Financial Officer Jimmy Patronis expressed his delight at the positive impact the growing number of residents and businesses has had on the state’s economy. (Photo by Octavio Jones/Getty Images / Getty Images)

According to Patronis, Florida’s appealing feature is its low-tax environment, which was ranked fourth overall in the Tax Foundation’s 2024 State Business Tax Climate Index. This advantage makes Florida highly attractive to businesses and individuals considering relocation, especially when compared to other competing states.

“When a company considers relocating, it engages in discussions with various states. Each state offers financial incentives to attract businesses. For instance, in Florida, we have a job grant growth fund specifically designated for public infrastructure and workforce development. In the upcoming year, we have a budget allocation of $75 million for this purpose,” he elaborated.

According to Patronis, one of the key advantages that sets Florida apart from other states is its low tax environment. He frequently interacts with families who have made the decision to relocate to Florida, and when asked about their reasons for doing so, the common response is not the weather or proximity to family, but rather the desire to benefit from the state’s low taxes. These individuals prioritize keeping more of their hard-earned money and Patronis strongly believes that citizens are better equipped to spend their money wisely than the government.

The resurgence of MLB Spring Training is fueling a tourism boom in Arizona and Florida.

Florida has 15 deepwater ports, such as Miami, that provide convenient access to the Caribbean and Latin America, according to Patronis.

According to him, businesses contemplating a move to Florida are provided assistance by the state. This assistance includes connecting them with site selectors and streamlining the permitting process. Moreover, exporters considering the state are offered additional incentives.

According to Patronis, the presence of competing states that are creating an unfavorable environment provides an excellent opportunity for Florida to demonstrate why it is the ideal place for businesses. He emphasized that Florida offers various advantages, such as guidance throughout the site selection process, workforce development support, and a streamlined permitting process. In fact, Florida is even willing to provide financial incentives to companies that choose to export goods from the state.

Florida’s economic strength, coupled with its robust infrastructure and proximity to Latin America and the Caribbean, positions it as a highly desirable hub for businesses.