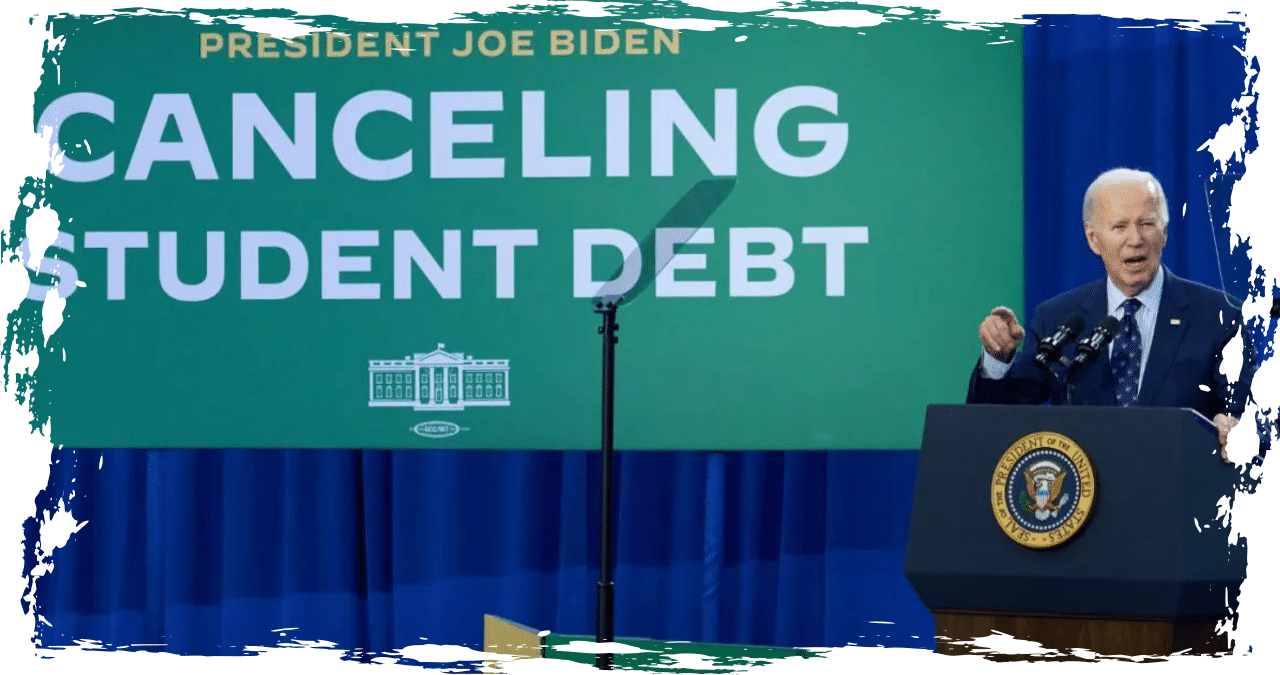

President Biden made a significant announcement on Wednesday, revealing his plans to eliminate student debt for over 160,000 borrowers.

The latest batch of borrowers will receive $7.7 billion in loan forgiveness under the new plan, adding to the total relief of $167 billion that President Biden has provided for 4.75 million Americans through his student debt actions. This loan forgiveness initiative is part of the newly established SAVE program and includes various income-driven repayment plans (IDR).

Around 160,000 borrowers fall under the Biden administration’s SAVE plan. These borrowers include public service workers like teachers, nurses, and law enforcement officials. Additionally, there are borrowers who were granted relief due to improvements made to Income-Driven Repayment (IDR) plans.

According to a statement from Education Secretary Miguel Cardona, the Biden-Harris Administration continues to be committed to providing student debt relief to a larger number of individuals. Cardona expressed that this announcement is a testament to their persistence, stating, “One out of every 10 federal student loan borrowers approved for debt relief means one out of every 10 borrowers now has financial breathing room and a burden lifted.”

During his campaign in 2020, Biden vowed to forgive student debt, and now he is intensifying his efforts to attract young voters in preparation for November’s election.

In a recent move, the administration took a significant step by forgiving student debt for over 277,000 borrowers. This initiative specifically focused on various groups, including public service workers, individuals on IDR plans, borrowers who were victims of school fraud, and those with disabilities.

In a recent move, Biden unveiled a proposal to provide much-needed relief to a staggering 25 million borrowers. This relief package aims to assist a wide range of individuals, including those who are currently on IDR plans, individuals who have participated in low-value education programs, those facing financial hardship, and borrowers who have seen their debt increase due to unpaid interest. However, it is worth noting that the plan is likely to face legal challenges if it is ultimately implemented.

In an effort to overcome the Supreme Court’s rejection of his student debt relief plan in June, the president has introduced new proposals.